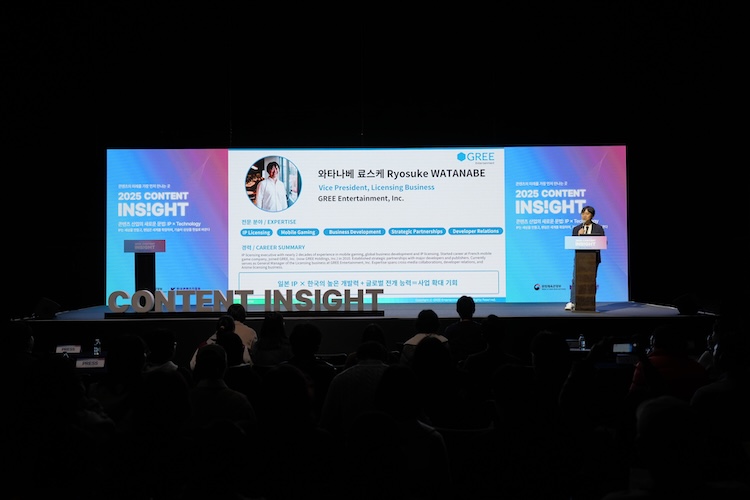

At KOCCA Content Insight 2025, Ryosuke Watanabe, Vice President of GREE Entertainment, presented a forward-looking keynote on “The Present and Future of Japan’s Animation IP Business — From Production to Global Licensing.”Drawing on two decades of experience, Watanabe outlined how Japan’s animation industry is adapting to global platforms, new IP strategies, and emerging collaboration with Korea’s creative and technological sectors.

The Changing Landscape of IP and Creativity in the AI Era

“Users have become creators,” Ryosuke Watanabe remarked, opening his keynote at the KOCCA Content Insight 2025 conference. As Vice President of GREE Entertainment and a veteran of Japan’s gaming and licensing sectors, Watanabe emphasized how this participatory ecosystem has reshaped the entertainment business. Within it, intellectual property (IP) has evolved from a creative asset into a global growth engine. It is the one that demands both strategic structure and human connection.

Having spent two decades in mobile gaming and IP licensing, Watanabe now oversees GREE Entertainment’s cross-media collaborations and animation licensing. His session, “The Present and Future of Japan’s Animation IP Business — From Production to Global Licensing,” explored how Japan’s anime ecosystem continues to expand beyond its traditional boundaries.

From Mobile Games to IP Ecosystems

Watanabe began by reflecting on his first visit to Korea 23 years ago. At that time, mobile phones were emerging, and Samsung ranked as the world’s third-largest company. “What hasn’t changed,” he said, “is the high technical capability of Korean companies and their ability to produce products that are globally accepted.”

That technical strength, he believes, complements Japan’s creative excellence. By linking Japan’s storytelling and IP development with Korea’s technology and production systems, new business opportunities can emerge across both markets.

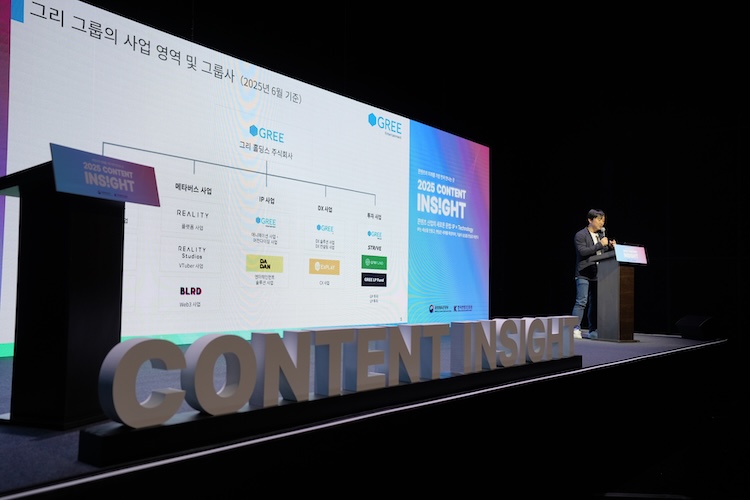

GREE Holdings, Watanabe explained, employs around 1,600 people and generates 50–60 billion yen in annual revenue. It is spread across five business segments: games, metaverse, IP, DX (digital transformation), and investments. Within that structure, GREE Entertainment — a 50-member subsidiary — has evolved from a mobile gaming company into an IP-driven enterprise focused on licensing and anime production.

Its notable collaborations include One Punch Man, Saint Seiya, Bleach, and Overlord. These are long-running titles that have generated over 100 billion won in cumulative revenue.

“Our mission is to excite the world with Japan’s premier IPs and games. We want to build sustainable ecosystems that expand IP value and fund future productions.”

Ryosuke Watanabe, Vice President of GREE Entertainment

Rather than stopping at production, the company aims to build sustainable ecosystems that expand IP value and fund future creations.

The Economics of Anime Production

Japan produces around 300 TV anime series annually, representing a market worth approximately 3.3 trillion yen (about 31 trillion KRW). The fastest-growing segments are overseas streaming and merchandising, driven by international audiences. If game revenues based on anime IPs were included, Watanabe noted, the total market would be significantly larger.

A new trend is the adaptation of Korean webtoons into anime, such as Solo Leveling (air in 2024) and The Beginning After The End (already broadcast to high acclaim). This shift reflects how anime has become a truly global medium. Visual storytelling is expanding fan communities more effectively than print alone.

However, Watanabe pointed out that the economics of anime remain challenging:

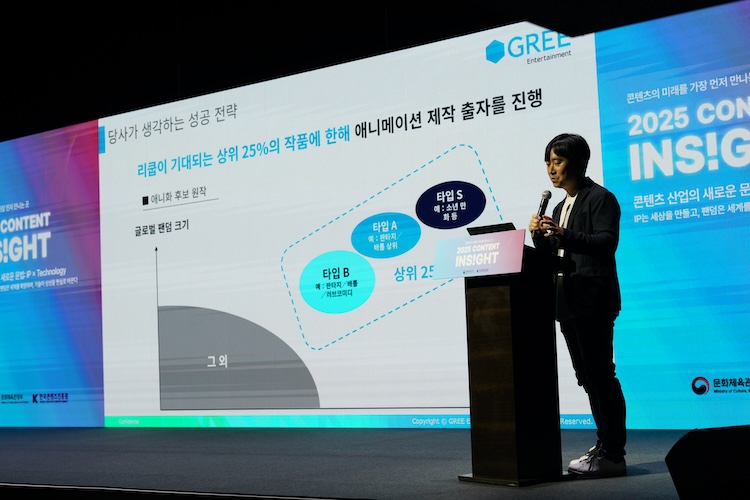

“About 75% of anime productions struggle to recover their production costs, while the remaining 25% drive the industry’s overall growth.”

Ryosuke Watanabe, Vice President of GREE Entertainment

To improve success rates, producers must focus on titles with strong cost-recovery potential. They must use global fandom analysis to guide investment decisions. Fan activity and user feedback, he said, are now vital data sources in production planning.

Building Long-Term Value

Despite financial risks, anime offers a remarkable long lifespan — with series from a decade ago still generating licensing revenue through global streaming, music, and merchandise. Sustained profitability depends on expanding IPs into related industries rather than relying solely on viewership or physical media sales.

“Our projects achieve around 75% cost recovery,” Watanabe shared. “Many series continue into Season 2 or Season 3, ensuring long-term returns.”

This serialization model, coupled with strong brand management, enables steady growth and audience retention.

Three Strategic Principles

Watanabe outlined GREE Entertainment’s approach through three strategic principles:

- Lead the production committees — staying at the creative center of anime development.

- Focus on titles with high recovery potential and serialize them for stable, long-term growth.

- Pursue global partnerships to expand sustainability and scale.

He noted that Japan’s production committee model — where multiple companies share investment risks and rights — could be expanded internationally to enhance transparency and efficiency.

As revenue streams shift from DVD and Blu-ray sales to streaming and digital distribution, maintaining flexibility in rights management and fostering cross-border collaboration becomes essential.

Collaboration Between Japan and Korea

Watanabe expressed strong interest in partnering with Korean developers and production studios, citing their technological capabilities and distribution expertise.

“Combining Japan’s production systems with Korea’s creative and development strengths can lead to new opportunities for both sides,” he said.

Ryosuke Watanabe, Vice President of GREE Entertainment

Such cooperation, he added, would allow GREE and its partners to grow faster than relying solely on Japan’s domestic market. Korea’s rising global presence in webtoons and gaming aligns naturally with Japan’s established animation IP networks. It creates a mutually beneficial ecosystem.

Looking Ahead

Watanabe closed his session with a simple invitation:

“If you’re interested in collaboration, please contact me or Mr. Kim Il-hwan, who oversees the Korean market with me. He speaks Korean, so feel free to reach out in that language as well.”

Ryosuke Watanabe, Vice President of GREE Entertainment

His message encapsulated both the spirit of partnership and the strategic future of Japan’s animation IP industry — one that thrives on creativity, data, and collaboration across borders.

Key Takeaways:

- Only 25% of anime titles fully recover production costs, but those successes sustain long-term industry growth.

- Streaming and merchandising are now the fastest-growing revenue sources.

- Korean webtoons are becoming key IP sources for Japanese anime studios.

- Success relies on ecosystem-based IP development — connecting games, music, and merchandise.

- Japan–Korea partnerships can enhance both creative innovation and market scalability.

Join us on an exciting journey to explore the vibrant world of Korean lifestyle – from the latest beauty tips to the hottest tech and so much more on Facebook, Twitter, LinkedIn, and Flipboard.