An in-depth analysis of the sharp decline in South Korean exports in the first half of 2025, shaped by US tariffs and changing trade dynamics.

South Korea entered 2025 with strong hopes for export growth, but U.S. tariffs quickly changed the outlook. South Korean exports have taken a significant hit in the first half of 2025. New tariffs from the United States are reshaping the trade environment between the two countries. Automobiles, steel, and home appliances faced new trade barriers, while semiconductors and pharmaceuticals held up better. The first half of the year shows how deeply tariffs are reshaping Korea’s trade patterns and business environment. This development is driving major changes in export strategies for Korean manufacturers.

Korean Exports Trade Trends in the First Half of 2025

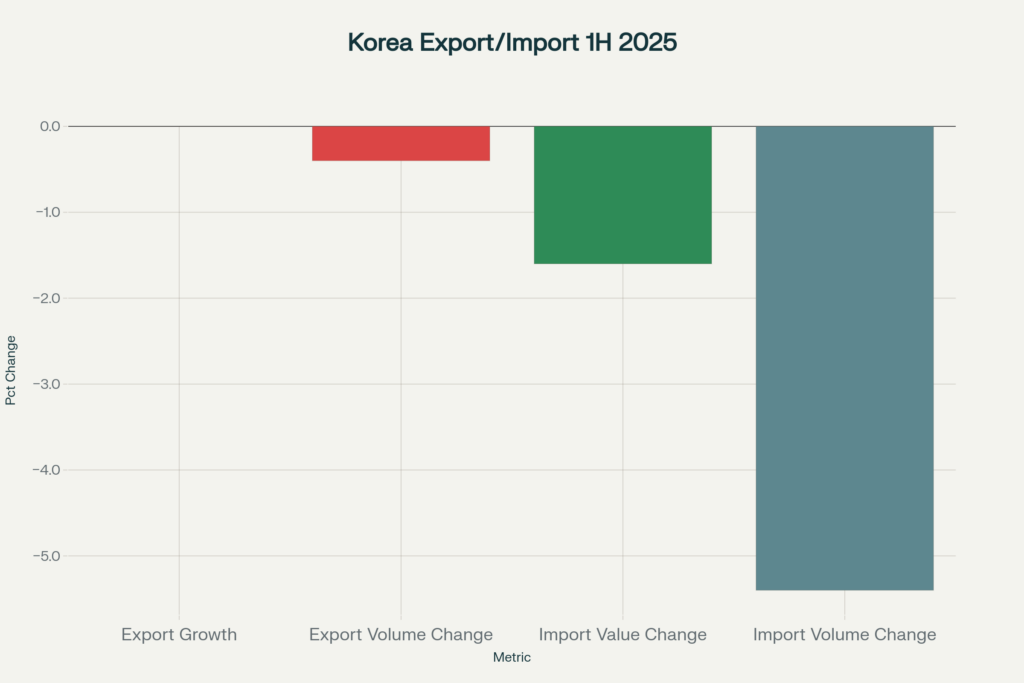

The first half of 2025 has been challenging for Korean trade. Export growth was relatively flat, with the total volume of exports slipping by 0.4% compared to the same period last year. The value of imports experienced a sharper decline, falling by 1.6% in dollar terms. When measured by volume, the imports decline by a more noticeable 5.4%.

Despite these weak figures, net exports (the difference between exports and imports) still made a positive contribution to Korea’s economic growth. This means that while overall export performance remained subdued, the steeper drop in imports helped support the country’s trade balance.

These headline numbers reflect the difficulties faced by Korean manufacturers under new trade barriers and softer demand, but also show some resilience in how Korea is managing its overall trade position during a turbulent time.

Sectoral Impact Overview – Which Industries Got Hit the Hardest

The pain came from familiar sectors. Automobiles, auto parts, steel, and appliances saw steep declines after the U.S. announced tariffs as high as 25%. Korean manufacturers that heavily depend on the U.S. market are feeling pressure to adjust their production and pricing.

On the other hand, semiconductors and pharmaceuticals stood out. Chips gained nearly 8% in value and 3% in volume, thanks to global AI-driven demand. Pharmaceuticals also performed well since they remain tariff-free. These sectors helped offset weakness elsewhere.

Semiconductors

Semiconductors continue to play a crucial role in the Korean economy, making up more than 20% of the country’s total exports. In the first half of 2025, chip exports showed solid growth, increasing by 7.8% in value and 3.3% in volume.

However, new tariffs from the US now pose a significant risk to the future of this sector. Currently, only 7% of Korea’s semiconductor exports go to the United States. China remains the largest single market, accounting for about 30%, but shipments there have decreased by 10.6% in value.

There is also a clear trend of Korean chipmakers expanding their exports to other regions, such as Taiwan, Malaysia, and India. This shift is influenced by ongoing changes in global supply chains and growing demand related to artificial intelligence technologies. Even with recent gains, the sector faces an uncertain outlook if tariffs become more restrictive.

Automobiles and Auto Parts

Automobiles and auto parts are Korea’s second-largest export group, accounting for around 13% of total exports. The impact of US tariffs has been especially severe here. Exports of cars and auto parts to the US fell by 16.4% in value and 12.5% in volume during the first half of the year.

Electric vehicle exports to the United States suffered the most, plunging by 89.1% in value and 88.8% in volume. Factors contributing to this sharp decline include not only higher tariffs but also lower US production capacity, recent changes in US tax incentives, and increased competition from other automakers such as Toyota.

Steels

Korean steel exports have also declined, a result of both higher tariffs and global market challenges like overcapacity and weaker demand. The United States has imposed a hefty 50% tariff on Korean steel, further compounding an already challenging environment. Non-tariff barriers and soft market conditions worldwide have made recovery in this sector unlikely in the short term.

Home Appliances

Home appliances have proven highly sensitive to tariff changes. Overall, Korean exports in this category dropped by 10.7% in value and 11.7% in volume. The US market saw even sharper declines, with exports falling by 20.6% in value and 19.7% in volume. Some recovery is possible if tariff uncertainties are resolved, but expectations remain muted for a meaningful rebound in the near term.

Medical Products

One of the few bright spots has been the medical products sector. Thanks to tariff exemptions, this segment achieved robust growth, with biopharma exports rising by 28.7% in value and cosmetics exports increasing by 13.1%. Korean firms have been diversifying their export destinations away from the US and China, but new tariffs planned for the second half of 2025 could put the momentum of this sector at risk.

Overall, each primary sector is experiencing the US tariff shocks in different ways. While some have found limited paths to growth, most are adapting by seeking new markets or revising their long-term strategies.

The Highly Anticipated Trade Deal

South Korea and the United States reached a critical trade agreement before the August 1 tariff deadline. This deal has set a benchmark tariff rate of 15%, aligning Korea’s treatment with that of other major trading partners like the EU and Japan.

Key Features of the Deal

The US will impose a 15% tariff on most South Korean goods exported to America. This is lower than the previously threatened 25% general tariff, offering some relief to Korean exporters. American exports to South Korea, however, remain tariff-free.

South Korea has committed to investing $350 billion in projects located in the United States over several years. This investment will focus on the shipbuilding, semiconductor, technology, and energy sectors, among others. Additionally, South Korea has agreed to purchase $100 billion worth of US liquefied natural gas and other energy products.

South Korea agreed to further open its markets to American goods, including automobiles, trucks, and agricultural products.

The deal specifically benefits the automotive sector by reducing car and auto parts tariffs to 15%, whereas these had temporarily spiked to 25%. Existing high tariffs on Korean steel, aluminum, and copper remain unaffected by this agreement, which is seen as a setback for Korean steel manufacturers.

Future Outlook

This agreement will ease some of the current tariff burdens and provide greater clarity for Korean manufacturers and exporters. In response to the tariffs and evolving trade policies, Korean companies are likely to take several steps:

- Increasing investment in the US to build production capacity locally.

- Diversifying export markets beyond the US to reduce dependency.

- Importing more goods from the US to balance trade relations.

Despite these strategic moves, tariffs will probably continue to weigh on Korean exports in the near term. However, the trade deal is likely to signal a period of stabilization and adjustment, allowing Korean manufacturers and exporters to better plan for the future.

Policymakers in Korea will closely watch the outcome of these negotiations, as it can influence broader economic strategies and bilateral relations for years to come.

Macroeconomic Implications for Korea

Looking ahead to the rest of 2025, Korea’s economic outlook is shaped by both the pressures from trade barriers and the domestic policy response. With the export environment remaining uncertain, the Korean government is expected to shift its focus more toward stimulating domestic demand. Increased government spending should help offset some of the adverse effects of weaker exports.

Additionally, monetary policy is likely to provide further support. The Bank of Korea is expected to lower interest rates by 25 basis points, a move aimed at boosting economic activity and sustaining confidence among households and businesses.

The outcome of ongoing trade negotiations will be significant for Korea’s broader economic strategy and for market sentiment. If a favorable trade deal is reached, it could pave the way for more stable policy decisions and reinforce Korea’s economic resilience in an unpredictable global market.

The trade deal is seen as stabilizing the situation for now, preventing more severe disruptions. However, the higher 15% tariff still represents a burden on South Korea’s export-dependent economy, which has already contracted slightly in the first half of 2025.

Conclusion

In summary, the first half of 2025 has revealed deep vulnerabilities in Korean export sectors amid newly heightened US tariffs. While some industries like medical products have managed to grow due to exemptions, most—such as semiconductors, automobiles, steel, and home appliances—are facing significant export declines and greater uncertainty.

Korean manufacturers are quickly adjusting, seeking alternative markets, and considering increased local investment abroad. The results of upcoming trade negotiations will play a critical role in shaping Korea’s economic direction for the rest of the year and beyond. Going forward, close monitoring of sectoral tariffs, potential reciprocal measures, and ongoing shifts in global demand will be essential for Korea’s exporters and policymakers alike as they navigate these challenging trade dynamics.

If you’re looking to promote your products and connect with international buyers, please don’t hesitate to contact us.