The Korean fashion sector has been under pressure, but a strategic shift toward athleisure is enabling leading local brands to outperform peers, diversify revenue streams, and capture overseas demand. This evolution — from a domestic-centric fashion slump to a performance-driven export opportunity — highlights a broader transformation in consumer behavior and competitive strategy in South Korea’s apparel industry.

Domestic Fashion Weakness Meets Athleisure Resilience

While the broader Korean fashion market has stagnated, homegrown athleisure brands like Andar and Xexymix have delivered record results. In mid-2025, Andar forecast about 300 billion won in revenue — a more than 25% year-on-year increase — marking its strongest performance in years. Xexymix similarly reported an all-time high revenue and significant overseas growth, especially in Japan, with sales up over 72% year-on-year from its Japanese unit.

This contrast matters: it shows that athleisure’s appeal is outpacing general apparel demand in Korea, underscoring a structural shift toward comfort and performance-oriented clothing that aligns with active lifestyle trends.

Market Growth: Size, Forecasts, and Consumer Appetite

Quantitative market estimates underscore the sector’s trajectory. According to IMARC Group, the South Korea athleisure market reached around USD 7.67 billion in 2024 and is expected to grow to USD 12.97 billion by 2033, with a 6.01% CAGR from 2025–2033. This growth is driven by rising health consciousness, casual lifestyle adoption, and technological fabric innovations.

Athleisure Market Projections (2024-2034)

Comparison of Korea, Southeast Asia (SEA), and Global Growth Tiers

Complementary forecasts suggest even stronger expansion scenarios — some estimates project a 9.8–10% CAGR through 2033, with footwear and tops as leading segments.

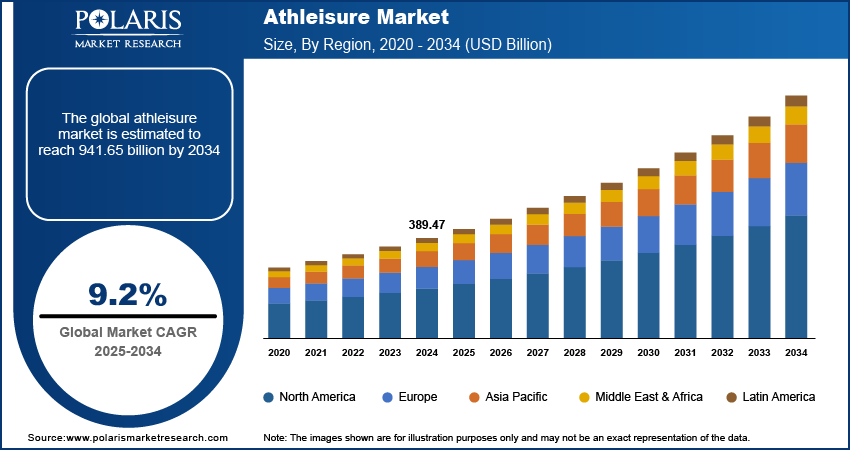

This growth mirrors global patterns. According to Polaris Market Research data, the global athleisure market could expand from about $389.47 billion in 2024 to nearly $941 billion by 2034 at an 8.8% CAGR, cementing athleisure as one of fashion’s fastest-growing categories.

Product Strategy: From Yoga to Performance and Footwear

The success of Korean brands is not incidental — it’s tied to strategic product diversification. Traditionally concentrated in yoga and Pilates apparel, brands have broadened offerings into performance running gear, golf wear, men’s segments, and footwear.

For example, demand for running products has surged. Andar’s running shoe line and Xexymix’s performance footwear saw significant uptake, with some product categories reporting quarterly sales increases of over 90% year-on-year.

This shift reflects changing consumer priorities: performance features (e.g., moisture-wicking materials, ergonomic design) and everyday comfort now rank as core purchase drivers across gender and age groups.

Overseas Expansion: Opening New Demand Vectors

Korean athleisure’s overseas playbook is gaining traction. Both Andar and Xexymix report robust international revenue contributions, particularly in Southeast Asia and Japan. Andar’s Singapore sales hit 1.2 billion won in a single month, while its Japan online business exceeded 2 billion won in a similar period. Xexymix’s Japanese unit consistently outpaced its previous full-year totals and helped drive overall brand growth.

This indicates that exports and international e-commerce are no longer experimental channels but meaningful growth levers — a trend aligned with Korea’s broader export resurgence across sectors such as tech and cultural goods.

Competitive Landscape: Local Leaders vs Global Players

Korean brands still operate in a competitive environment shaped by global incumbents. Lululemon’s online direct-to-consumer growth in Korea, for instance, underscores how premium foreign brands are capturing share.

However, local players are forging differentiated routes via regional market specialization, localized pricing and product mix, and cultural branding leverage — advantages that can mitigate global competitive pressures.

Risks and Headwinds to Consider

Despite positive momentum, several risks could temper growth:

- Macroeconomic volatility and discretionary spending constraints could affect premium athleisure purchases.

- Overseas operational costs and marketing investments (e.g., in China and Southeast Asia) can pressure profitability if not aligned with local demand patterns.

- Supply chain disruptions and raw material cost swings remain industry-wide concerns.

Understanding and managing these structural and operational risks will be crucial for sustainable expansion.

Strategic Takeaways for Industry Decision-Makers

K-athleisure’s evolution from a domestic fashion niche to a globally relevant category illustrates how product strategy and international market focus can unlock growth even amid sectoral decline. For industry stakeholders — from brand strategists to investors — the key lesson is clear: vertical diversification and export-first planning are core to capturing next-wave apparel demand.

This trend also positions Korean athleisure as a potential flagship export within the broader consumer goods ecosystem, building on Korea’s cultural and design capital.

Join us on an exciting journey to explore the vibrant world of Korean lifestyle – from the latest beauty tips to the hottest tech and so much more on Facebook, Twitter, LinkedIn, and Flipboard.