From LED masks to AI-driven skincare tools, Korean beauty-tech is reshaping the home-beauty landscape — and forcing legacy brands to adapt fast.

The Rise of Beauty-Tech 2.0

Korea’s skincare world is changing fast. What once revolved mainly around serums, creams, and layered routines is now being re-imagined as a convergence of cosmetics and consumer electronics. This new wave—what we might call Beauty-Tech 2.0—is gaining traction in Korea, as at-home beauty devices move from niche to mainstream.

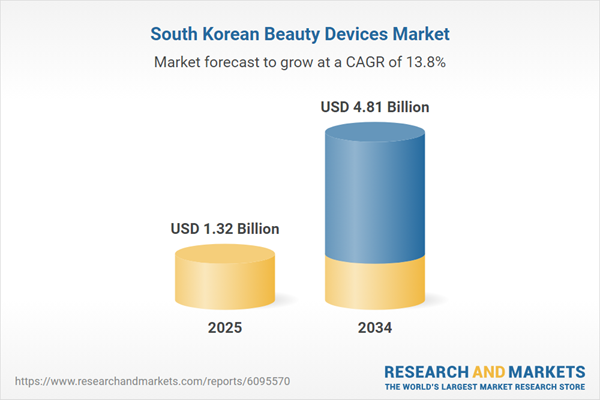

Recent research shows how big this shift has become. The South Korea beauty-devices market was worth about USD 1.32 billion in 2024. Analysts expect it to grow at an annual rate of 13.8 % through 2034, reaching around USD 4.81 billion. This steady rise reflects how consumers want visible results, clinic-level performance, and easier self-care at home.

This shift signals more than just a new product category. It reflects consumers demanding treatment-level efficacy, enhanced convenience, and smart integration. In Korea’s highly competitive beauty ecosystem, device-based solutions are challenging legacy paradigms of skincare. Korea’s reputation as a leader in beauty and personal care continues to solidify, with domestic companies focusing increasingly on tech-enabled solutions.

We’ll look at the key brands driving it, how traditional companies are adapting, and where investors see opportunity. We’ll also trace how these tech-driven products are expanding beyond Korea’s borders.

Market Shift: From Serums to Sensors

The skincare market in Korea is undergoing a clear transformation. Consumers are moving away from purely topical routines—lots of serums and creams—and embracing devices they can use at home. Smart beauty tools such as LED therapy masks, micro-current rollers, and cleansing devices are gaining serious traction.

Several factors fuel this shift. First, there is rising demand for measurable performance: consumers want results they can see and feel—not just marketing claims. Second, at-home convenience has become key: devices let users replicate clinic-level treatments in their living rooms. Finally, smart features—AI skin analysis, app-connectivity, personalization—are boosting appeal.

Device categories are also diverging fast. Analysts divide the market by product type (e.g., hair-removal, cleansing, rejuvenation), and by application (home usage versus salons/spas). Home-use devices, in particular, show strong growth. For example, a recent report describes how LED masks, cleansing brushes, portable micro-current rollers and even hair-care devices now form part of the beauty-tech wave in Korea. These tools are more than add-ons—they’re becoming central to how skincare is consumed.

This change is important for the K-Beauty ecosystem. Traditional brands that built their reputation on formulas must now compete with hardware-based systems. In short: skincare is no longer just about what you apply—it’s about what you power.

Meet the New Players — and How Korea’s Beauty Giants Are Responding

Korea’s beauty industry is entering a new era. From tech startups to global conglomerates, companies are fusing skincare with engineering to create devices that deliver measurable results. The movement is reshaping how consumers think about self-care — and how legacy brands define their future.

Classys Inc.: Bridging Clinics and Homes

Classys Inc., based in Seoul, is one of Korea’s best-known medical-aesthetic device makers. The company develops ultrasound, radio-frequency, and HIFU (High-Intensity Focused Ultrasound) systems, sold in more than 60 countries worldwide. Its brands, such as Ulfit and Scizer, serve both professional clinics and home users. This dual focus shows how Korean firms are blending clinical precision with consumer convenience — a hallmark of the country’s beauty-tech edge.

LG Pra.L: Electronics Meets Skincare

LG Electronics has moved beyond TVs and smartphones with its Pra.L beauty line, marking the tech giant’s formal entry into personal care. The lineup includes LED masks, total-care facial devices, and toning tools. Initially launched in South Korea, Pra.L has since expanded to markets including Singapore and Hong Kong. The devices use LG’s strength in sensors and ergonomics to deliver professional-grade skincare at home.

BeautIT and Venus Labs: The Startup Disruptors

While big brands dominate visibility, startups are driving much of the innovation. BeautIT recently secured a US $4 million investment to develop AI-enabled skincare tools that analyse the skin and deliver personalised care through connected apps. Similarly, Venus Labs is blending design and machine learning to create at-home devices tailored to each user’s skin condition. These emerging companies represent the next generation of K-Beauty entrepreneurship — agile, digital-first, and globally focused.

Legacy Leaders Pivot to Tech

The success of startups has pushed Korea’s heritage brands to rethink their models. Amorepacific, the country’s largest cosmetics house, now integrates devices directly into its product ecosystem. Its MakeON line pairs serums and creams with at-home tools that stimulate the skin and enhance absorption. The company has also developed digital skin-analysis mirrors that link to mobile apps for personalised routines. This move reflects its wider goal to merge beauty with biotechnology and AI.

Another long-established player, LG Household & Health Care (LG H&H), is fusing cosmetics and IoT. The company has unveiled AI-driven diagnostic features and wearable-linked skincare devices for its premium brands, allowing users to monitor skin health in real time. These innovations mark LG H&H’s shift from traditional beauty manufacturing toward connected wellness technology.

Smart Masking and Collaborative Growth

Sheet-mask pioneer Mediheal is venturing into smart masking systems that sync with mobile apps to analyse skin before recommending mask types or timing. This approach keeps the brand relevant as consumers demand data-driven skincare.

At the same time, established firms are forming strategic partnerships rather than relying only on internal R&D. Amorepacific and LG H&H have both invested in early-stage tech startups focused on AI diagnostics, sensor materials, and connected beauty tools — recognising that hardware innovation moves faster than conventional cosmetic cycles.

Heritage Meets Hardware

Together, these innovators — new and old — illustrate a turning point for K-Beauty. Startups bring speed and data intelligence; conglomerates bring scale, trust, and global reach. By merging these strengths, Korea is building a complete beauty-tech ecosystem where heritage meets hardware, and skincare becomes smarter with every device.

Globalisation: Korean Devices Go Global

Korean beauty-tech is no longer a local phenomenon. Over the past two years, a wave of Korean device makers has entered international markets, positioning their products as high-performance, design-led, and affordable alternatives to Western brands. This global expansion underscores Korea’s growing influence in the intersection of beauty and technology.

Expanding Beyond Asia

Major players like LG H&H, CellReturn, and Amorepacific’s MakeON are leading Korea’s export surge. Its success shows that “Made in Korea” is now shorthand for both innovation and reliability in beauty hardware.

The U.S. and Europe: New Frontiers

Korean beauty-tech is also entering Western markets. Retailers such as Nordstrom and Amazon have started featuring K-beauty devices alongside established beauty brands, helping niche players reach global consumers. Analysts note growing interest in AI-powered, app-connected devices, particularly in the U.S. and U.K., where demand for personalized skincare is expanding.

However, entering these markets is not easy. Companies must navigate regulatory approvals, including FDA clearance in the U.S. and CE certification in the EU. These processes can delay launches and increase costs. Despite that, Korean firms continue to push forward, leveraging their reputation for innovation and consumer trust.

Localization and Branding Strategies

To appeal to overseas consumers, many Korean brands are localizing both marketing and design. LG Pra.L, for example, tailors packaging and product tutorials to English-speaking markets, while startups like BeautIT are developing multilingual apps to guide usage. This localisation not only improves user experience but also helps brands stand out in crowded marketplaces.

Korean beauty-tech exports reflect the next phase of the K-Beauty wave: from content to commerce, and from formulas to hardware. By combining design excellence with advanced engineering, Korean brands are proving that beauty innovation can travel just as powerfully as pop culture.

Investor Lens: The New Beauty Frontier

The surge in Korea’s beauty-device market isn’t only a consumer trend — it’s attracting investors across Asia and beyond. Venture capital firms are now treating beauty-tech as a serious innovation category, merging hardware, data, and wellness into one scalable business model. Recent funding rounds show growing capital flow into Korean beauty-tech startups.

Why Beauty-Tech Appeals to VCs

Venture firms are drawn to beauty-tech for three main reasons.

- Recurring revenue: Devices linked to consumables or app subscriptions create ongoing income.

- Data advantage: Smart devices gather user insights that can guide new product development.

- Export scalability: Hardware and software platforms can be localized quickly for global markets.

Analysts describe beauty-tech as sitting “between health tech and luxury beauty,” combining lifestyle branding with measurable performance — a combination that aligns with global investor appetite for wellness innovation.

Challenges for Investors and Founders

Despite the enthusiasm, risks remain. Developing hardware is capital-intensive, and consumer devices require strict regulatory compliance and after-sales support. Brands must also navigate different beauty-device regulations across Korea, the U.S., and the EU. For investors, this means balancing high growth potential with higher technical and compliance risks.

As Korea’s beauty-tech ecosystem matures, investors are no longer chasing simple cosmetic trends — they’re betting on connected skincare systems that integrate sensors, AI, and smart materials. The line between skincare and consumer electronics is blurring, and venture capital is following that signal.

Consumer Experience & Regulation

As beauty devices become part of everyday routines, Korean consumers are reshaping how the industry defines trust and safety. The surge in at-home use has made user education, product transparency, and regulatory clarity more important than ever.

Consumers Seek Clinic-Grade Results at Home

Surveys and retail reports show strong local demand for at-home devices that promise professional-level results. According to market analyses, younger Korean consumers in their 20s and 30s are the fastest-growing demographic for smart skincare tools. They value measurable effects and easy integration into existing beauty routines.

Consumers also expect safety and legitimacy. Brands now publish device test results and collaborate with dermatologists to back their claims. These partnerships help build confidence in a category that sits between beauty and medical technology.

Navigating Korea’s Tightening Rules

The Ministry of Food and Drug Safety (MFDS) regulates most beauty devices under Korea’s Medical Device Act, requiring clinical data for certain functions such as RF or LED-therapy devices. Companies must secure separate permits for domestic sales and exports. As demand rises, the MFDS is tightening oversight on advertising language and performance claims to curb exaggerated marketing.

Global expansion adds another compliance layer. Korean firms exporting to the U.S. need FDA 510(k) clearance, while entry into Europe requires CE Mark certification. Each process can take months and significantly increase development costs. However, companies see regulatory approval as a long-term asset that enhances global credibility.

Balancing Innovation and Safety

For Korean brands, the challenge lies in moving fast without cutting corners. Developers must balance innovation with ethical marketing, ensuring that device claims are clinically supported. In response, some beauty-tech firms are forming joint R&D programs with dermatology clinics and university labs to strengthen credibility and improve safety testing.

Korea’s proactive stance on consumer protection may seem demanding, but it also boosts the country’s global reputation. By combining rigorous regulation with advanced R&D, Korean brands are setting a new benchmark for safety and performance in the global beauty-tech market.

What’s Next: Skincare Becomes Smartcare

Korea’s beauty-tech revolution is only getting started. The next generation of devices will blur the boundaries between skincare, health tech, and lifestyle. As sensors become more precise and AI becomes more accessible, “smartcare” — a term Korean analysts increasingly use — is emerging as the next growth frontier.

The Next Wave of Innovation

Analysts expect new products to integrate AI-driven diagnostics, connected apps, and wearable patches that track hydration and elasticity in real time. Some Korean firms are already piloting skin-scanning cameras and LED micro-patches that deliver controlled light therapy while collecting user data. These tools turn beauty routines into feedback systems — where every session produces measurable insights.

Convergence of Wellness and Technology

The Korean industry’s future lies in convergence. As companies link beauty, wellness, and digital health, they’re creating integrated ecosystems that track stress, sleep, and skin condition together. Global players like LG and Amorepacific are already collaborating with healthcare startups to explore biometric data applications in skincare. This trend reflects how K-Beauty is evolving into a broader K-Wellness narrative.

Global Influence and Cultural Export

Korean beauty-tech’s success is influencing global standards for product design, regulation, and marketing. Export figures and global retail placements show that consumers from Singapore to Los Angeles now associate “K-Beauty” with innovation, data, and personalization — not just skincare routines. As the next wave of startups emerges, the term “Made in Korea” could soon signify smart beauty, much like “K-Pop” came to define cultural influence.

Korea has always set trends in global beauty. Now, it is setting the pace for how technology and wellness merge. The future of K-Beauty won’t be bottled — it will be coded, connected, and powered by innovation.

Join us on an exciting journey to explore the vibrant world of Korean lifestyle – from the latest beauty tips to the hottest tech and so much more on Facebook, Twitter, LinkedIn, and Flipboard.