It’s been a long time since console gaming has completely dominated the global industry and international market. But in 2025, that crown is starting to wobble, and the one shaking it is none other than Donald Trump. Yes, the Donald Trump, the one and only. With the new Trump tariffs targeting gaming consoles, the Western market is now bracing for a ripple effect in cost, demand, and player sentiment, but not in South Korea. While chaos looms over Sony, Microsoft, and Nintendo, Korean developers are standing calmly on the sidelines, more prepared than anyone else to take the lead in the mobile and PC game industry.

So, what happens next? Let’s talk about the impact of the Trump tariffs on console and how this will impact the mobile and PC game industry in South Korea. And even more so, why could this moment actually mark a long-overdue global shift in favor of Korean gaming IPs?

Global Console Gaming is Under Pressure, Thanks to Trump Tariffs

On April 3, 2025, the Trump administration announced a policy shift that shook the hardware-centric gaming world: up to 25% tariffs on imported consoles, including the upcoming Nintendo Switch 2, PlayStation 5, and Xbox Series X/S.

This then resulted in an immediate impact, with Nintendo delaying its U.S. preorders for the Switch 2, and major console stakeholders began pushing back. The Entertainment Software Association (ESA) warned that this new policy would hurt manufacturers, developers, publishers, and consumers alike, calling it a threat to the entire U.S. game ecosystem.

And yet, the shockwave didn’t stop there. More ripple effects will soon be hitting the production pipeline, the retail market, and, most of all, gamers’ wallets. With cost hikes looming on both ends of the supply chain, the once-steady console upgrade cycle now seems a lot less certain.

The Rising Power of Korean Mobile and PC Game Industry – Just in the Right Time

Now, this is where the Trump tariffs get interesting, especially for South Korea.

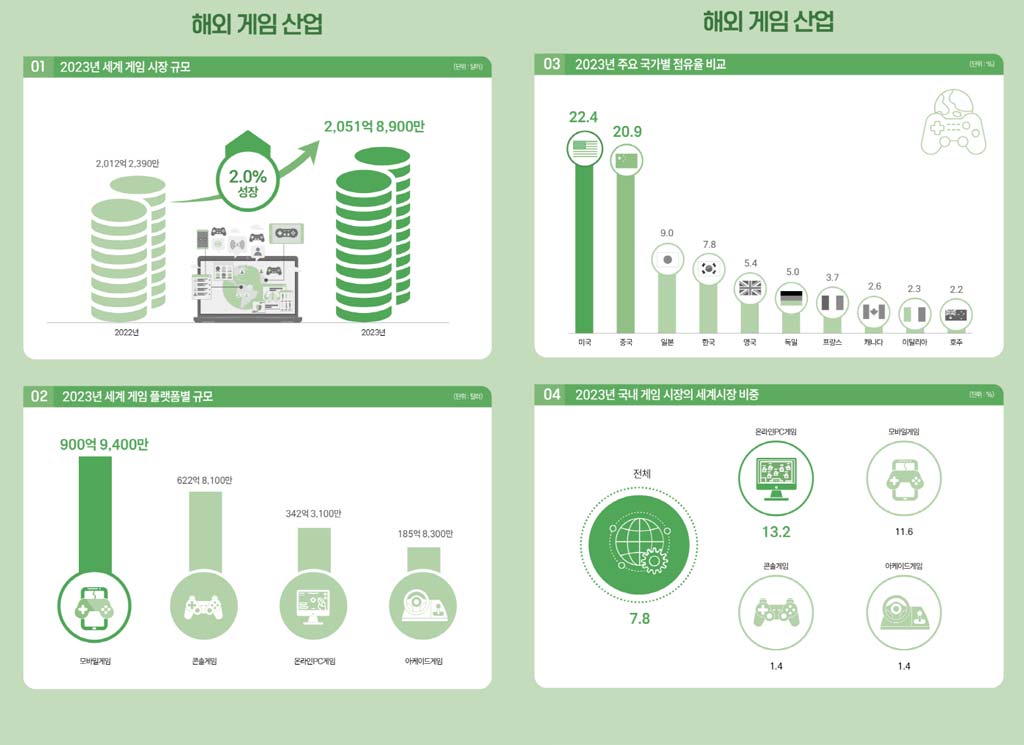

Unlike Japan or the U.S., South Korea never built its gaming empire around consoles. According to the 2024 Korea Game White Paper, a staggering ₩19.4 trillion (approx. 14.2 billion USD) out of the Korean ₩22.9 trillion (approx. 16.7 billion USD) total gaming revenue in 2023 came from the mobile and PC game industry, accounting for over 84.9% of the domestic market.

The strength of the Korean game industry lies in its hybrid development culture: story-driven MMORPGs, competitive mobile titles, and live-service PC games with global appeal. Not only that, but companies have already distributed the games digitally with impressive cloud optimization features and in-app purchases as well as IP-based content monetization approaches.

Due to these approaches, hardware sales are never a priority in the Korean mobile and PC game industry. And so, when console manufacturing takes a hit due to tariffs, Korean game developers aren’t scrambling to pivot. After all, they’re already one step ahead.

Gaming Market of South Korea Remains Strong Amid US Trump Tariffs

It has been a while since South Korea has been relying more on its IP-first, platform-agnostic business structure.

For example, you can take a look at how KRAFTON monetizes PUBG. They did it not just through the base game, but through skins, battle passes, mobile versions, and even multimedia spinoffs. Not to mention all the exciting cross-genre collaborations.

At the same time, you can also witness how Smilegate’s “Lost Ark” thrives through Steam globally without ever needing a console port.

And it’s not just games. Korean entertainment IPs like SM Entertainment and HYBE are now deeply intertwined with gaming, expanding reach through character licensing, metaverse platforms, and fan-interactive experiences. It’s a cross-industry synergy that console-first markets simply don’t have at this scale.

That’s why, as soon as the tariffs were announced, Korean stocks jumped. KRAFTON’s stocks rose 1.59%, SM Entertainment got even higher at 4%, and game/entertainment-related ETFs rebounded sharply. That’s because investors didn’t just see resilience. They saw a clearer path forward—and it didn’t involve a console.

Global Gamers May Shift Their Preferences

Moreover, the impact of the US Trump Tariffs will soon become more than just a hardware issue. With the prices rising and gamers’ cash supply sinking, the impact will soon result in a shifting consumer behavior.

As prices rise for consoles, accessories, and even boxed games, everyday players—especially in the US—may start reconsidering their entertainment spending. Many of them are already familiar with mobile-first titles or free-to-play ecosystems. All it takes is one extra 100 USD added to a console’s price tag to trigger a deeper exploration of games they can access through phones, PCs, or cloud platforms.

And where will they turn?

Probably not toward another $70 boxed copy—but maybe toward a polished, addictive, lore-rich Korean MMORPG that’s available free on Steam. Or a sleek mobile title with TikTok buzz and cross-platform sync. The shift may not be immediate, but it’s coming.

What Developers Must Do Now for Korean Mobile and PC Game Industry

Of course, opportunity alone doesn’t guarantee success. Korea’s developers must now make bold, strategic moves to capture this global moment:

Double Down on Localization

Language is no longer enough. Culturalization, regional server support, and influencer engagement are critical for converting curious players into loyal ones.

Invest in Low-Spec Optimization

Not every gamer in the West has a high-end PC. Studios like Wemade and Nexon need to ensure their games perform smoothly on lower-tier hardware.

Push New IPs for International Tastes

Now is not the time to play it safe. Global gamers are ready for new stories, settings, and mechanics. Think less medieval Korea, more speculative sci-fi, global dystopia, or narrative-driven co-ops.

Launch During the Window of Disruption

With Nintendo delaying and console momentum stalling, smart timing can make or break a title’s global impact.

Trump Tariffs: A Groundbreaking Change for South Korea

Well, ironic, isn’t it? The Trump Tariffs, a US trade policy designed to protect domestic manufacturing, may end up giving international developers, especially those in South Korea, the upper hand in the digital entertainment war.

No, it doesn’t mean that console market is disappearing, but its dominance is facing one of the greatest challenges in history. And for Korean PC and mobile game industry, it has become a rare turning point. Something that doesn’t come often in an industry ruled by giants.

While the rest of the world scrambles to figure out what comes after consoles, Korea’s already ahead—armed with the platforms, the player base, and the momentum.

Now, all that’s left is just the right push.

Because after all, the rules are changing. And if anyone’s ready to set the pace for the next era of global gaming, it might just be South Korea.

If you’re looking to promote your products and connect with international buyers, please don’t hesitate to contact us.

Join us on an exciting journey to explore the vibrant world of Korean lifestyle – from the latest beauty tips to the hottest tech and so much more on Facebook, Twitter, LinkedIn, and Flipboard.