K-Beauty startups bounce back in 2025 with $4.9M in new funding, reigniting growth after a sluggish 2024 & highlighting early-stage innovation.

The K-beauty industry is appreciated all over the world for its advancements and innovations. With increasing global cultural influence, the industry continues to take up prominent space in the beauty and cosmetics industry. And this is supported by more than 1,100 companies across the world.

According to Traxcn research, 74 startups in this sector have secured funding, with South Korea leading both in terms of the number of companies and the total amount raised. South Korean startups account for over 55% of the total funding in the sector. What makes K-beauty stand out is its high-quality products, natural and innovative ingredients, and unique formulations. Not only that, the widespread influence of Korean pop culture through K-pop, K-dramas, and social media platforms makes it even more popular worldwide.

Traxcn Report highlights

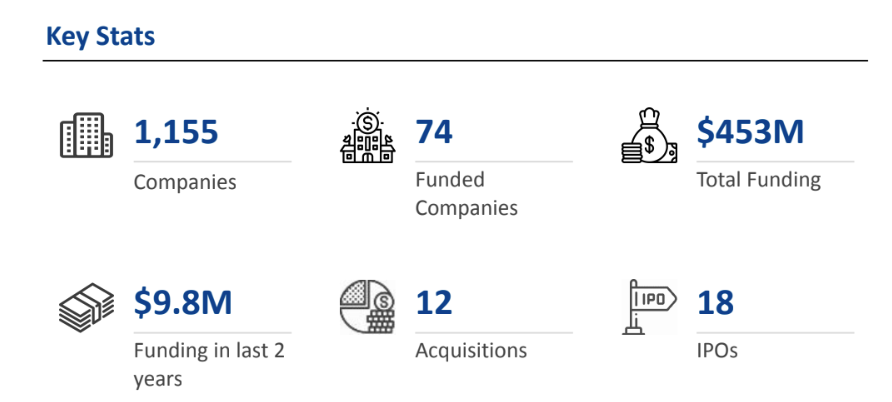

- K-beauty startups have secured $453 million in funding, with South Korea leading the market.

- In the first four months of 2025, K-beauty startups have secured $4.9 million in funding, indicating a recovery after a challenging 2024.

- In the initial stages of the funding rounds, early-stage investors have accounted for the majority of the funding allocated in 2022, 2023, and 2025.

- Memebox, GP Club, and Clio Professional are the top financially backed K-beauty startups.

- To date, the ecosystem has witnessed the emergence of two unicorns, the launch of 18 initial public offerings (IPOs), and the acquisition of 12 companies.

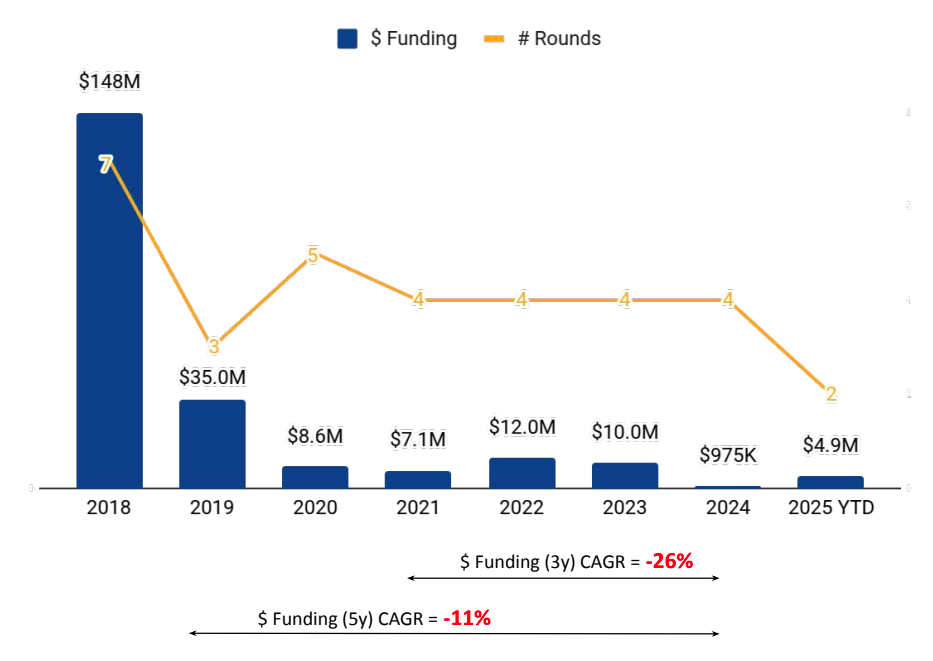

Funding Peaks and Recent Decline

With a recent funding decline in 2024, the beauty sector in South Korea is showing a revival in funding momentum in 2025. A recent report by Traxcn highlights that K-beauty startups raised $4.9 million in the first four months of 2025. It exceeds the mere $975,000 total funding in 2024. These new investments in early-stage rounds indicate a sharp turnaround for an industry with the lowest funding in a decade last year.

To date, the K-beauty sector has garnered approximately $453 million in funding, with South Korea leading both in terms of the number of companies and the proportion of capital raised. The global popularity of K-beauty is driven by the high quality and innovation of its products and the widespread influence of K-pop and K-dramas. All these continue to be a key factor in the sector’s resilience.

Year-on-Year Funding Trends in the K-beauty Industry

The K-beauty industry’s funding history has seen boom years followed by steep declines. The funding was at its peak in 2016 and 2018, when investments hit $186 million and $148 million respectively. Funding activity dropped sharply afterward, culminating in 2024’s trench of just $975K. It is a 90% plunge from the $10 million raised in 2023. The year 2024 was the lowest in annual funding for K-beauty startups in the past ten years. However, 2025 appears to be a recovery phase. By April, the sector has already secured $4.9 million in funding, indicating a cautious rebound after the previous year’s slump.

Early-Stage Rounds Now Dominate

In recent years, the nature of K-beauty funding has shifted dramatically toward earlier-stage deals. Early-stage rounds (Series A and B) have driven the majority of funding in the past five years. In fact, all of the sector’s funding in 2022, 2023, and 2025 (year-to-date) came from early-stage investments. By contrast, there are no late-stage (Series C or later) investments in the K-beauty space over the last five years.

Early-stage financing now accounts for roughly 27.8% of total funding to date (about $126M), while late-stage rounds, mostly from the mid-2010s peak, still make up about 69% ( ~$311M ) of cumulative funding.

The absence of recent late-stage capital suggests that newer K-beauty startups are raising initial rounds, but few are (yet) scaling to the big Series C+ raises that characterized the earlier era.

Seed-stage activity is also modest. Only $15.3 million in seed funding has been recorded for K-beauty startups to date. To date, there are no seed deals in 2025, and 2024 had roughly $957K in seed funding. This indicates that while investors are backing new companies at Series A/B, there aren’t any brand-new seed-stage entrants in 2025 to date.

Top-Funded K-Beauty Startups

Amid these shifts, a few startups stand out for having amassed significant war chests. The top three funded K-beauty companies to date are Memebox (with $193 million raised), GP Club ($67.5 million), and Clio Professional ($50.1 million).

Memebox, originally founded in Seoul and now operating globally, is known for its e-commerce platform and private-label beauty products, making it the highest-funded player in the space. GP Club is a cosmetics manufacturer behind popular Korean brands, and Clio is a veteran color cosmetics label. These three K-beauty companies round out the list of top fundraisers, reflecting investor appetite for both innovative upstarts and established brands in K-beauty’s portfolio.

Leading Segments in K-Beauty

A few key product segments, each with distinct trajectories, have attracted concentrated K-beauty investments:

- Color Cosmetics remains the highest-funded segment, attracting a total of $245 million in investments over the years. This category saw its peak in 2016 when a surge of funding reflected global excitement around Korean makeup brands. However, there has been a noticeable cooling in recent months, with no new funding recorded in 2025 so far, suggesting investor interest may be shifting elsewhere.

- Multi-Category Beauty startups have gained ground more recently. These companies are the ones that offer a broader mix of skincare, makeup, and other beauty products. These companies have raised a total of $77 million to date, and all of the capital injected into K-beauty in 2025 so far has gone to this segment. It signals a rising preference for brands that can serve as one-stop shops for K-beauty consumers across different product lines.

- Skincare is another foundational pillar of K-beauty’s global success. Startups in this category have raised $46.5 million in total, with their biggest funding year being 2018. In 2025, however, there has yet to be new investment activity in skincare-specific companies. Despite the current lull, the skincare segment continues to resonate strongly with consumers worldwide thanks to its reputation.

Exits: Acquisitions, Unicorns, and IPOs

The K-beauty startup ecosystem is maturing as is clearly visible by prominent exits and milestones. Across the industry, there has been the acquisition of 12 K-beauty industries to date. In January 2025, the most significant recent acquisition occurred when South Korean natural skincare brand Manyo was acquired by private equity firm Klpartners for $129 million. Another notable exit was the U.S.-based K-beauty brand The Crème Shop, which was purchased by LG Household & Healthcare for $120 million in 2022. These acquisitions highlight the continued interest of larger entities in acquiring promising K-beauty labels, particularly those with a global presence.

K-beauty has also minted its share of unicorns and public companies. To date, two startups have achieved “unicorn” status, characterized by valuations exceeding $1 billion: GP Club, which attained a $1.3 billion valuation in 2019, and Mediheal, a facial mask brand that became a unicorn in 2017. Concurrently, 18 K-beauty companies have gone public through initial public offerings (IPOs) thus far. The most recent IPO was APR, a K-beauty device and cosmetics firm that debuted on the public markets in 2024.

The consistent stream of IPOs and the presence of unicorns suggests two possible reasons. First, the ecosystem is maturing and strategic investors are acquiring the most successful startups. Secondly, these startups have attained sufficient scale to access public capital.

Investor Landscape in K-Beauty

The funding trends in K-beauty have been shaped by an evolving cast of active investors. Overall, the sector’s top venture backers include major international firms like Goodwater Capital, Pear VC, and Altos Ventures Management. All of the investors have notable investments in consumer and tech startups globally. These firms have been prominent supporters of K-beauty’s growth, leveraging their expertise in scaling consumer brands.

In the past two years, early-stage and seed deals in K-beauty have been driven by a mix of global and local funds. On the seed front, investors such as 500 Global (formerly 500 Startups) and Barlon Capital have been among the most active, signaling international interest in seeding the next wave of K-beauty brands. At the Series A/B stage, Korean venture investors like Company K Partners and Smile Gate Investment have taken leading roles in funding rounds, providing early capital to help startups scale. This blend of Silicon Valley money and Korean domestic investment has been crucial in sustaining the sector, even during the recent lean years.

Consumer Trends and Future Outlook

The reason behind K-beauty startups’ success is its enduring consumer appeal, which points to potential growth ahead. Today’s consumers increasingly seek products that are science-backed, ethical, and contain high-quality ingredients. And these are the attributes of all Korean brands.

From cruelty-free formulations to eco-friendly packaging, Korean beauty companies are at the forefront of creating effective and responsible beauty products. Many Korean brands now prioritize vegan, clean ingredients and sustainable practices to meet the evolving expectations of global consumers. Simultaneously, Korean beauty is famous for integrating traditional skincare knowledge with cutting-edge scientific advancements. The industry consistently introduces novel ingredients and technologies, reflecting a growing trend of science-based skincare. These factors have solidified Korean beauty’s position as a global trendsetter in the beauty industry.

In the future, analysts anticipate that the global popularity of K-beauty will only intensify over the coming years. Industry forecasts indicate robust growth for the sector, driven by its extensive international fan base and adaptable product strategies. For instance, one analysis predicts that the global K-beauty market will expand from approximately $11.2 billion in 2025 to $20.4 billion by 2035. It reflects a steady annual growth rate of approximately 6%. If these current trends persist, the early funding increase observed in 2025 may be indicative of significant future developments. Investors anticipate that K-beauty’s combination of ethics, efficacy, and excitement will propel its global expansion for years to come.

What Does it Mean for K-beauty Startups?

1. Renewed Investor Confidence in K-Beauty

The $4.9 million raised in early 2025 signals that despite a difficult 2024, investors are once again showing faith in the sector. For Korean startups, this means the capital pipeline is opening back up, especially for early-stage ventures. It marks a shift from uncertainty to cautious optimism, allowing founders to begin planning growth and innovation with greater confidence.

2. Opportunity for Emerging Startups

With all 2025 funding so far going into early-stage rounds, new and emerging K-Beauty startups in Korea have a chance to step into the spotlight. This environment favors bold new entrants with disruptive products. Strong brand storytelling and a clear value proposition can help startups that are blending skincare science with ethical practices and trend-driven innovation.

3. Need for Sustainable Differentiation

As competition rises and investors become more selective, Korean startups will need to go beyond just leveraging K-pop or traditional beauty cues. They’ll have to build brands that are sustainable, inclusive, and backed by R&D. Startups that prioritize clean beauty, dermatological efficacy, and eco-friendly packaging are likely to stand out in investor pitch rooms.

4. Shift Toward Multi-Category Models

The fact that all 2025 funding went to multi-category K-Beauty brands shows a trend toward diversification. Korean startups focusing narrowly on single-product verticals may need to expand their offerings or partner strategically. There’s growing investor preference for scalable, full-stack brands that can own larger slices of the consumer beauty journey.

5. IPO and Acquisition Pathways Are Realistic

With 18 IPOs and 12 acquisitions in the ecosystem, South Korean founders can now reasonably aspire to long-term exits, whether via public markets or strategic buyers. The $129M acquisition of Manyo in 2025 is a strong signal that M&A activity is alive and well. These exits create a virtuous cycle: recycled capital, experienced operators, and stronger institutional belief in the sector.

6. Global Expansion Remains Key

K-Beauty’s international appeal is its superpower. For Korean startups, global scalability is not optional, it’s a necessity. Investors are likely to back founders who think beyond domestic distribution and prioritize international partnerships, D2C channels, and overseas pop-up or retail pilots. Those that succeed globally can tap into not just capital, but enduring consumer love and loyalty.

If you’re looking to promote your products and connect with international buyers, please don’t hesitate to contact us.