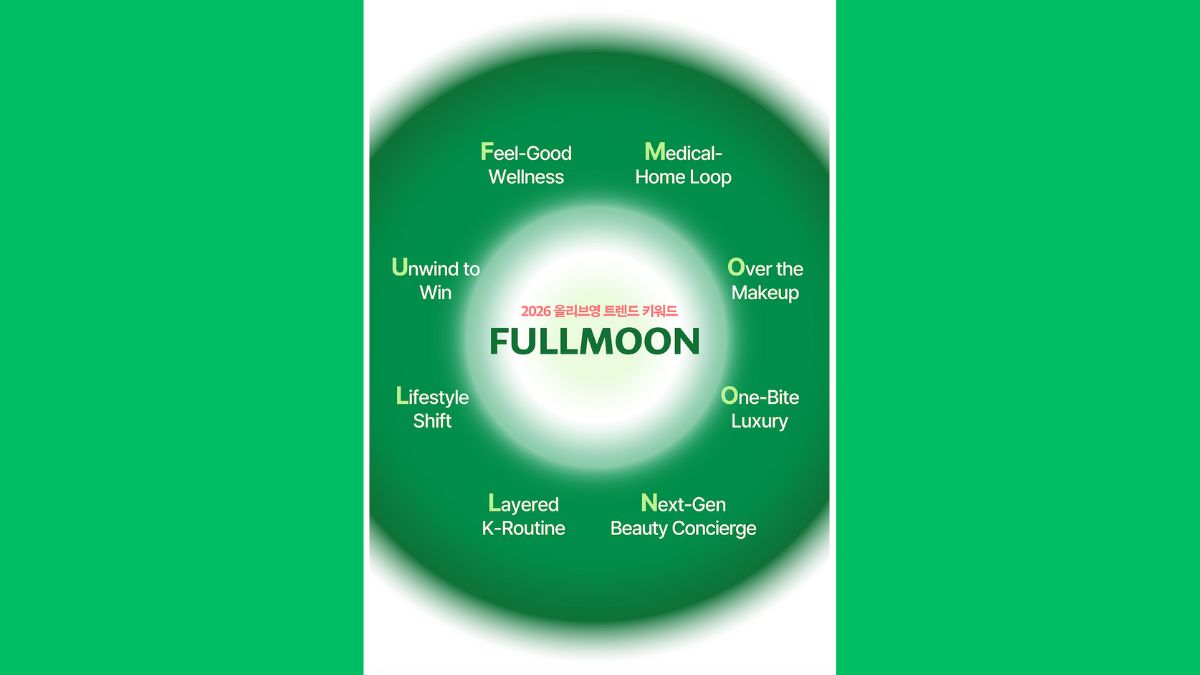

The 2026 Olive Young keyword FULLMOON reveals how K-beauty, wellness, and lifestyle are converging into the next growth phase.

CJ Olive Young’s annual trend keyword has become a reliable signal of change in Korea’s beauty and wellness market. For 2026, the company selected “FULLMOON.” The term reflects more than evolving consumer taste. It points to a structural shift in how beauty, wellness, and lifestyle converge.

As Korea’s leading beauty and health retailer, CJ Olive Young sits at the center of consumer demand and category growth. Its trend keywords rely on sales data, in-store behavior, and digital consumption patterns. The Olive Young keyword, FULLMOON, therefore functions as a market framework, not a marketing slogan.

FULLMOON as a Business Signal, Not a Buzzword

FULLMOON represents wholeness and balance. In business terms, it signals a move away from appearance-led beauty. Consumers now prioritize outcomes such as emotional comfort, recovery, and long-term well-being.

This shift aligns with broader changes in the global beauty and wellness economy. According to the Global Wellness Institute, wellness has become a core spending category rather than a discretionary add-on, with consumers seeking products that improve how they feel, function, and perform in everyday life.

For Olive Young, FULLMOON confirms that beauty retail is evolving into lifestyle infrastructure. Skincare, supplements, body care, and functional food now operate within a single consumer ecosystem.

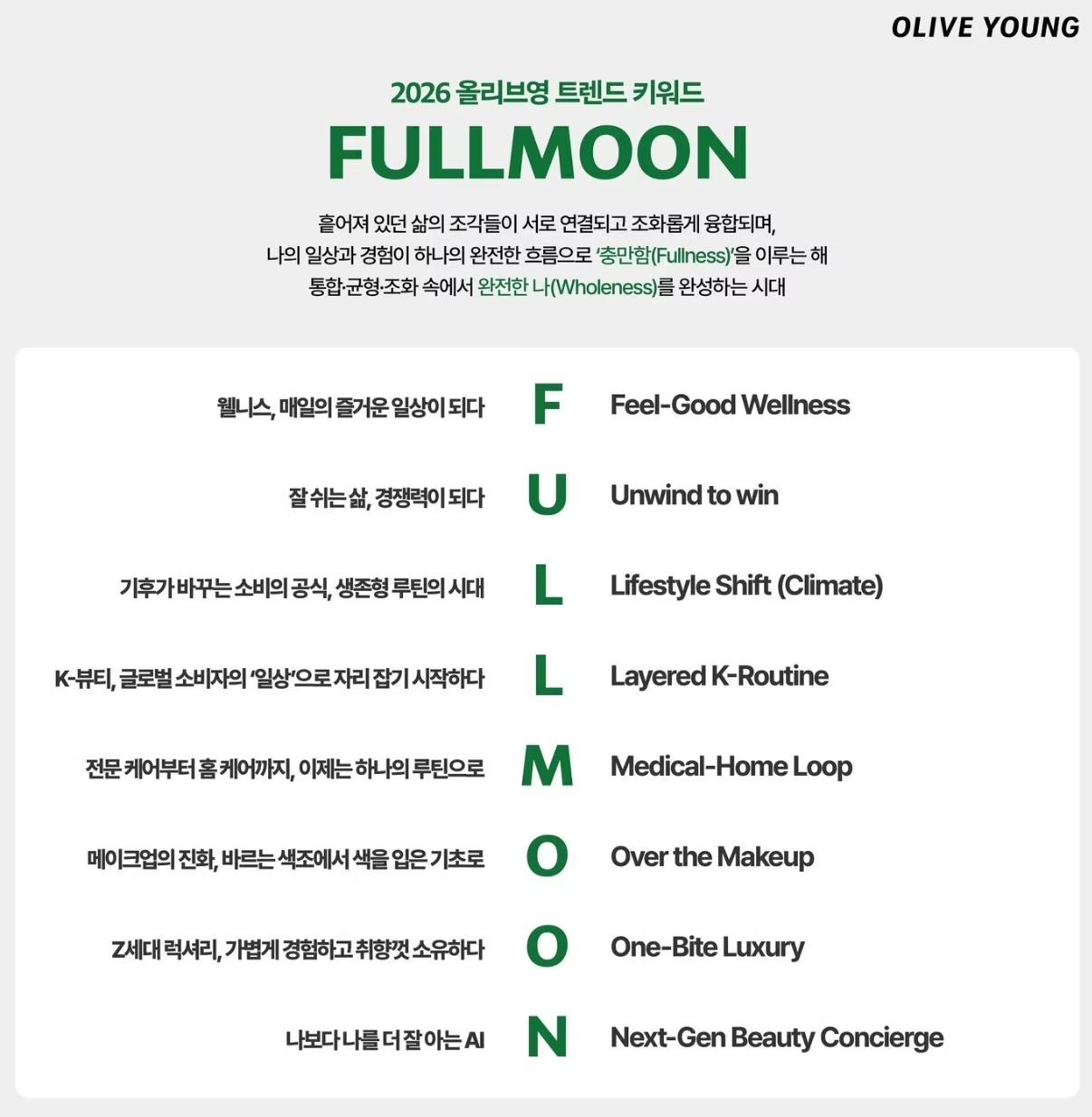

Decoding FULLMOON: Eight Consumer Shifts Reshaping Retail

FULLMOON functions as an acronym that captures eight consumer shifts shaping Olive Young’s retail strategy. Together, these trends explain how beauty consumption is evolving from product-centric purchasing to lifestyle-driven decision-making.

Feel-Good Wellness

The first pillar, Feel-Good Wellness, reflects rising demand for products that support emotional comfort and everyday balance. Consumers increasingly treat skincare, body care, and supplements as tools for mood regulation rather than purely aesthetic enhancement. Sensory experience, gentle formulations, and emotional reassurance now influence purchase decisions as much as visible results.

Unwind to Win

Unwind to Win highlights the growing importance of rest and recovery. Sleep quality, stress management, and nighttime routines have become central to wellness-oriented beauty consumption. Products designed for evening use, relaxation, and recovery continue to show strong retail performance, reinforcing rest as a commercial growth category.

Lifestyle-Responsive Products

FULLMOON also points to the demand for lifestyle-responsive products. Modern consumers expect beauty items to adapt to climate, mobility, and time constraints. Compact formats, multifunctional products, and climate-aware formulations outperform traditional single-purpose SKUs in this environment.

Layered but Personalized Care

K-beauty routines are evolving under FULLMOON. Layered but personalized care replaces rigid multi-step regimens with flexible systems. Consumers now build routines based on skin condition, lifestyle, and data-driven recommendations. Technology enables customization, making personalization a core value driver rather than a premium add-on.

The Medical–Home Care Loop

The medical–home care loop reflects continued growth in derma cosmetics and clinic-inspired skincare. Consumers increasingly connect in-clinic treatments with daily at-home maintenance. This trend strengthens demand for products that combine clinical credibility with retail accessibility and reinforces trust as a key purchase factor.

Over-the-Makeup

Under FULLMOON, makeup plays a supporting role in skin health. Over-the-makeup refers to cosmetics formulated with skincare benefits, such as barrier support and soothing ingredients. Hybrid products like serum foundations and skin tints continue to blur the line between skincare and color cosmetics.

One-Bite Luxury

One-bite luxury captures consumers’ preference for small, affordable indulgences. Rather than committing to high-ticket prestige items, shoppers favor mini products, wellness snacks, and everyday rewards. This behavior supports high-frequency purchasing and creates attractive margin structures for retailers.

Next-Generation Beauty Concierge

The final pillar, next-generation beauty concierge, highlights the role of AI and data-driven personalization. Olive Young continues to invest in technology that improves product recommendations and shopping efficiency. Personalized guidance increases conversion rates and strengthens customer lifetime value, making beauty tech a strategic growth lever.

Why FULLMOON Emerged Now

FULLMOON reflects measurable consumer behavior, not speculation. Post-pandemic shoppers value sustainable routines and preventive care. Categories linked to daily well-being outperform trend-driven products.

Gen Z and Millennials accelerate this shift. Their purchases favor multifunctional products and wellness-integrated beauty. These patterns confirm FULLMOON as a response to structural demand.

What FULLMOON Means for Brands and Investors

FULLMOON highlights where scalable opportunities exist. Hybrid beauty-wellness brands, derma skincare, functional supplements, and personalization platforms align with Olive Young’s strategy.

The framework also reinforces Olive Young’s role as a market gateway. Brands that perform well under these pillars gain visibility and distribution leverage. For investors, FULLMOON points to repeat-purchase models and defensible category growth.

Global Implications Beyond Korea

While FULLMOON originates in Korea, its relevance extends globally. Similar shifts toward functional beauty, wellness integration, and experience-led retail appear across the US, Europe, and Southeast Asia. Olive Young’s trend keyword effectively previews how these movements consolidate at the retail level.

For international buyers and partners, monitoring Olive Young’s keyword strategy offers early insight into how K-beauty continues to shape global beauty retail standards.

FULLMOON as a Blueprint for Sustainable Growth

FULLMOON is not a short-term forecast. It serves as a long-term blueprint for K-beauty and wellness growth. The framework reflects how consumers now define value, balance, and care.

As Olive Young continues to shape category development and global brand discovery, FULLMOON sends a clear message. The future of beauty lies in completeness, not excess.

Join us on an exciting journey to explore the vibrant world of Korean lifestyle – from the latest beauty tips to the hottest tech and so much more on Facebook, Twitter, LinkedIn, and Flipboard.