Navigate the evolution of K-Beauty in 2025 – an illustrated analysis of market shifts, segment shares, and more that’s redefining the industry worldwide.

If you’re even slightly curious about global beauty trends, you’ve seen K-beauty on the shelves and your social feed. But what’s fueling its next phase of expansion in 2025? The K-beauty market is projected to reach anywhere from $11.2 billion to $15.4 billion this year, keeping up a healthy compound annual growth rate of 6.1–10.3%. We’re breaking down what’s driving this surge, by segment, by channel, across regions, tapping into the innovative spirit and global flavor that define Korea’s beauty industry.

Let’s jump into the story of how K-beauty continues to shape and surprise the world of cosmetics.

2025 Market Snapshot

The K-beauty industry in 2025 is making waves worldwide, not just with its flagship brands but with numbers that highlight real momentum. Here’s a look at the current landscape and what’s setting the pace this year.

Market by the Numbers

- Estimated Market Value (2025): $11.2–$15.4 billion

- Compound Annual Growth Rate (CAGR): 6.1%–10.3%

- Top-selling Segments: Skin care leads, followed by innovative hybrid makeup and fast-emerging hair care

- Strongest Sales Channels: Online retail is surging, powered by live streaming, mobile-first platforms, and influencer-powered shopping experiences

What’s Fueling the Surge?

- Cultural Capital: The relentless momentum of Hallyu, from hottest K-pop groups to binge-worthy K-dramas, drives international curiosity and trust in Korean products.

- Digital Commerce Acceleration: E-commerce, particularly through mobile and live commerce channels, now claims a larger market share than ever, removing global borders for both Korean brands and buyers.

- Product Innovation: Skinimalism, microbiome care, and “clean” ingredients aren’t just buzzwords. They’re shaping new launches and evolving consumer preferences quickly.

- Social Discovery: Viral product moments, thanks to TikTok tutorials and influencer hauls, can turn niche products into global must-haves overnight.

2025 K-Beauty Market Size & Channel Growth

| Metric | Value/Trend (2025) |

|---|---|

| Total Market Size | $11.2–$15.4 billion |

| CAGR | 6.1% – 10.3% |

| Skincare Share | >60% of market value |

| Online Retail Share | Fastest-growing, over 74% in Korea |

| Market Hubs | Asia-Pacific (core), N. America, EU |

This snapshot sets the stage for a sector where digital-first strategies, cultural influence, and ingredient science aren’t just trends. They’re the very engines of growth.

Product-Based Segmentation: What’s Hot in 2025?

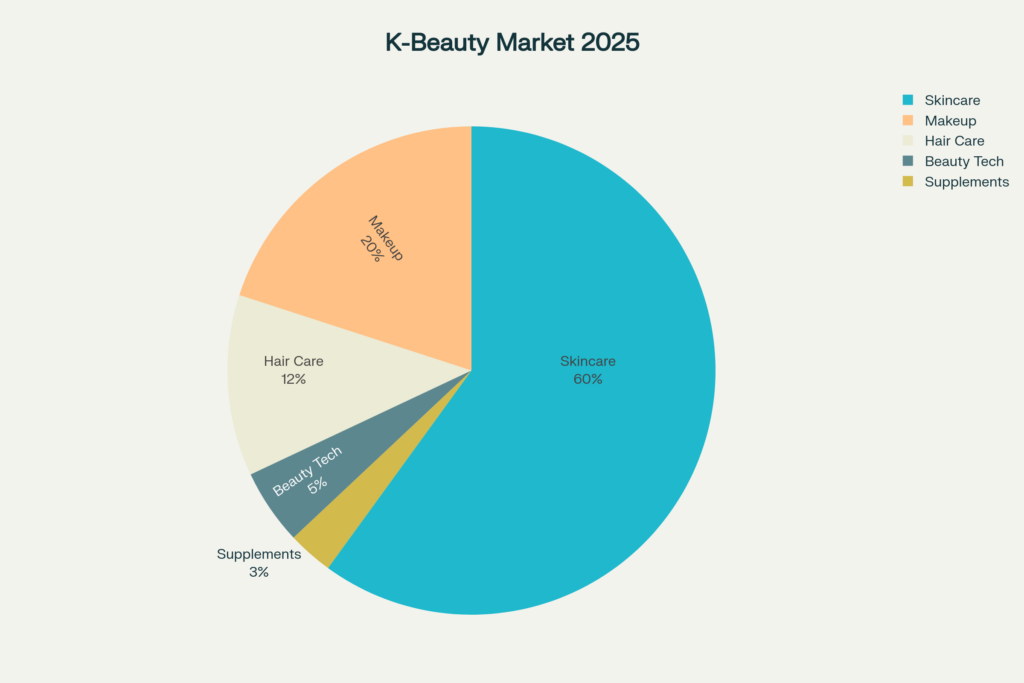

Market Share by Product Category (2025)

| Category | Market Share (approx.) | Key Trends |

|---|---|---|

| Skincare | ~60%+ | Skinimalism, ingredient innovation |

| Makeup | ~20% | Hybrid (skincare-infused) formulas |

| Hair Care | ~10–12% | Scalp care, natural ingredients |

| Beauty Tech | ~4–5% | At-home devices, LED masks |

| Supplements | ~2–3% | “In & out” beauty routines |

Skincare: The Core Pillar of K-Beauty

It’s no secret—K-beauty and skincare are virtually synonymous around the world. In 2025, skincare accounts for more than 60% of the total K-beauty market value, cementing its spot as the industry’s driving force. Standout product categories include cleansers, toners, serums, and essences; each plays a specific role in the multi-step routine that has become iconic both in Korea and globally.

Emerging trends shaping the skincare landscape:

- Skinimalism: Minimalist routines that use fewer, multifunctional products are gaining popularity among time-starved consumers who still seek serious results.

- Microbiome-friendly formulations: Innovative products designed to balance and protect the skin’s natural ecosystem.

- Gentle, science-backed actives: Ingredients like heartleaf extract, cica (Centella asiatica), and niacinamide are gaining traction for their efficacy and skin-soothing benefits.

- Hybrid textures: Serums that double as moisturizers or toners, infused with light essences, cater to users wanting convenience without compromise.

Insider Tip: Brands that bridge traditional herbal knowledge with contemporary skincare science are seeing the highest demand, especially when they pair innovation with sustainability.

Makeup: The Hybrid Revolution

K-beauty makeup isn’t about heavy, mask-like finishes. The shift toward “no-makeup makeup” means customers are seeking tints, balms, and blurring creams that subtly enhance their natural appearance without overpowering it. BB and CC creams, early exports of the K-beauty wave, continue to be reimagined, now packed with skincare actives for all-day nourishment.

Key themes:

- Skincare-infused color (moisturizing foundations, sun protection in makeup)

- Lightweight, buildable formulas for easy layering and a natural finish

- Multi-use sticks and palettes for quick, effortless looks

Hair Care: Rising Fast

While still smaller than skincare and makeup, hair care is among K-beauty’s fastest-growing segments. The global audience is waking up to the importance of scalp health, a concept that’s long been mainstream in Korea.

Growth drivers:

- Scalp treatments and exfoliating tonics

- Gentle, sulfate-free shampoos and essence sprays

- Spa-like at-home hair rituals, reflecting the popularity of Korean hair clinics

Emerging & Functional Segments

K-beauty never stands still. New directions in 2025 include:

- Beauty Tech: LED masks, microcurrent devices, and AI-powered skin analyzers are increasingly finding their way into home vanities, bridging the gap between clinical science and daily self-care.

- Supplements: “Glow from within” is serious business, with collagen drinks and beauty probiotics making their way into everyday routines.

- Personalized Care: AI-driven platforms recommend routines based on skin types, environments, and individual needs, making customization more accessible than ever.

K-beauty’s strength lies in its ability to keep evolving, matching global trends with the creativity and quality the world expects from Korean brands.

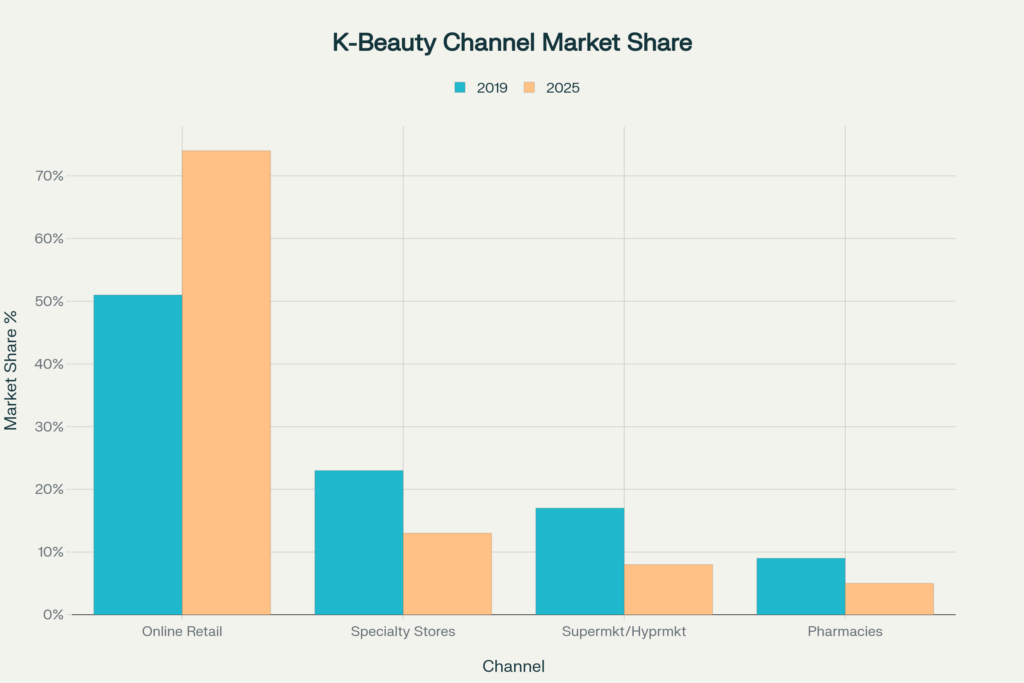

Channel-Based Segmentation: Where Are People Shopping?

In 2025, how and where consumers buy their K-beauty favorites has become almost as important as the products themselves. The data reveals that online retail is now indisputably the sector’s leading growth engine. What makes this especially notable isn’t just the convenience. It’s the way brands, influencers, and consumers connect in real-time. In South Korea, over 74% of beauty sales occur through online channels. Shoppable live streams, influencer recommendations, and mobile-first platforms drive these sales. Global shoppers are just as engaged, discovering new brands through viral tutorials and social discovery on TikTok and Instagram Live.

As shoppers crave both convenience and expertise, specialty beauty boutiques and branded stores continue to hold their ground. It is true especially for premium brands where an immersive in-store experience and personal consultations help finalize purchase decisions. Physical stores remain relevant for those who want to try before they buy, target luxury shoppers, or seek tailored expert advice. Meanwhile, supermarkets and pharmacies are the unsung heroes for mass-market and health-driven products. These locations offer trusted shelves for bestselling affordable picks or cosmeceuticals with dermatologist backing.

Below, a visualization captures the evolving landscape of K-beauty distribution channels from 2019 through 2025:

The takeaway? K-beauty brands that lean into digital engagement, invest in influencer partnerships, and do not shy away from new online retail technologies are capturing consumer attention and loyalty worldwide. At the same time, the in-person experience remains crucial for select sectors and premium positioning.

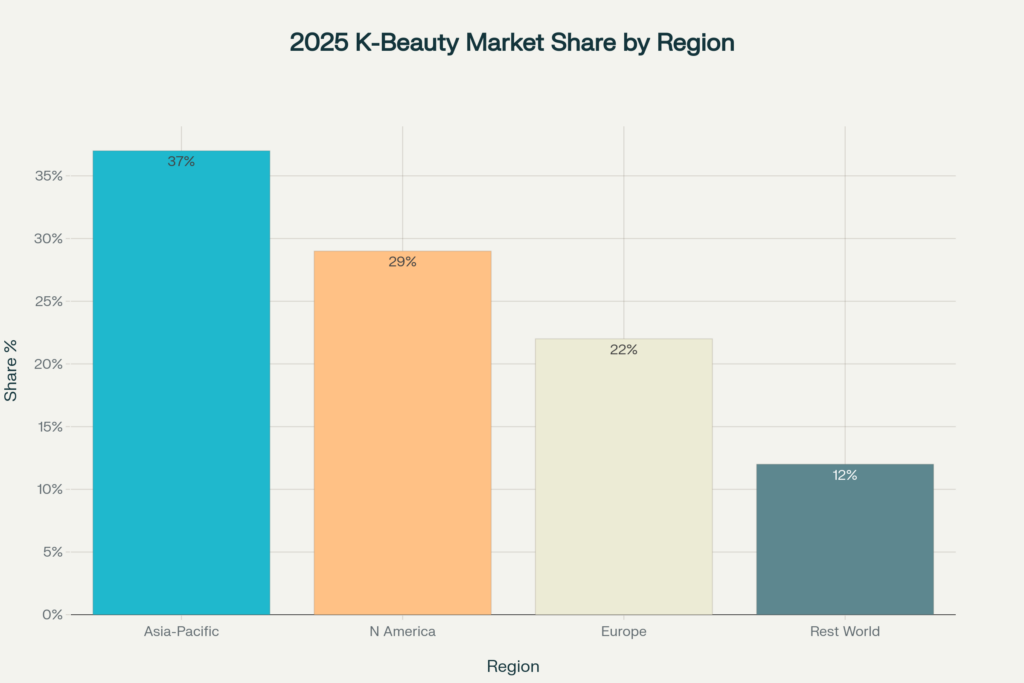

Regional Segmentation: Global Growth Hotspots

K-beauty may have started as a regional phenomenon, but by 2025, its market will be fully global, with each region putting its spin on “Korean beauty.” Nowhere is this more apparent than in the numbers: the Asia-Pacific region still dominates, claiming over a third of the market, but North America and Europe are accelerating with their own distinct priorities and growth curves.

Within the Asia-Pacific region, Korea leads innovation, acting as both a trend incubator and the primary consumer base. Fast-moving cities like Seoul, Tokyo, and Shanghai drive demand for new launches and fast-evolving beauty rituals. K-beauty’s rise in China, despite regulatory challenges, demonstrates the region’s continued cultural pull and willingness to experiment with unique ingredients and regimens.

Meanwhile, North America is experiencing a K-beauty moment driven heavily by skincare. Gen Z and millennials in the U.S. and Canada, always on the lookout for efficacy and transparency, flock to brands that emphasize multifunctional actives and science-backed results. It’s not unusual to see K-beauty-led trends, think “glass skin” or “jelly cleansers”, go viral. They are powering double-digit growth for brands that can back it up with real performance.

Europe brings a different lens: the demand here is for clean, sustainable beauty. K-beauty’s embrace of eco-friendly formulations, cruelty-free certification, and ingredient transparency has enabled brands to establish a foothold. And K-beauty in 2025 is making a place among discerning European consumers who are as focused on planet-first as they are on personal beauty. EU regulations regarding claims and ingredients have also encouraged K-beauty brands to adapt their labeling and marketing strategies, further professionalizing their global expansion.

Regional Market Data: 2025

| Region | Share of Global K-Beauty Market | Top-Selling Categories | Key Growth Drivers |

|---|---|---|---|

| Asia-Pacific | ~35–38% | Skincare, Hair Care | Innovation, trend-setting cities |

| North America | ~28–31% | Skincare, Makeup | Performance, social virality |

| Europe | ~20–23% | Skincare, Clean Formulas | Sustainability, regulation |

| Rest of World | ~8–12% | Mixed | Emerging retail, digital access |

Regional growth is far from monolithic. Each market has its unique regulatory landscape, consumer preferences, and digital ecosystem. The magic of K-beauty in 2025 lies in its ability to adapt, tapping into hyper-local trends with the same ease as it jumps across platforms or borders.

K-Beauty Regional Market Shares & Drivers (2025)

As we examine this international mosaic more closely, it becomes clear that the “K” in K-beauty stands for more than Korea. It now signifies agility, inclusivity, and the ability to connect with beauty lovers everywhere.

Strategic Insights: 2025 Growth Drivers Recap

In 2025, K-beauty’s global momentum is underpinned by a complex web of strategic forces that extend far beyond individual products or viral trends. The heart of K-beauty’s sustained growth is its agile fusion of innovation, digital engagement, and value-driven storytelling.

Dominance of Skincare

One of the most significant underlying drivers is the dominance of skincare, which consistently secures more than 60% of the total K-beauty market value. This isn’t just about routine; it’s about the broader narrative around skin health, preventive care, and the seamless integration of traditional botanicals with modern science. Brands that invest in education, demystifying ingredients like heartleaf or snail mucin, are winning consumers by translating complex science into everyday benefits.

Digital Ecosystem

The digital ecosystem has revolutionized how brands connect with consumers. Online-first approaches, especially via mobile and social media, have redefined what it means to discover, try, and recommend beauty products. Short-form videos, real-time live commerce, and genuine influencer testimonials can catapult niche launches into global success overnight. The ability to adapt messaging quickly, react to trends, and personalize offerings through data is now fundamental for growth.

Ingredient innovation and sustainability

The clean beauty movement, driven by demands from European and North American markets, requires brands to demonstrate not only efficacy but also ethical stewardship. Claims of “eco-friendly,” “cruelty-free,” or “biodegradable packaging” now factor into whether consumers try, trust, and repurchase.

Ultimately, K-beauty thrives on its ability to turn data and trends into culturally resonant stories—bridging tradition and technology, and satisfying a diverse, ever-evolving global audience. This ecosystem supports not just short-term sales bumps but long-term loyalty and brand elevation, positioning Korean beauty at the vanguard of the global cosmetics industry.

Future Outlook: What to Expect in K-Beauty Beyond 2025

K-beauty has never been content to stand still, and the road ahead promises even more transformation. As we look past 2025, several dynamic forces are set to reshape the industry, each building on the sector’s hallmark blend of tradition, technology, and trendsetting global culture.

Personalization

Personalization will take center stage. With the rapid advancement of artificial intelligence and at-home diagnostic tools, consumers will soon craft hyper-customized skincare routines tailored to their unique skin profiles, local climates, and daily routines. Expect AI-powered apps to recommend products, adjust regimens in real time based on environmental factors, and even track results through app-enabled skin scans.

Inclusivity

Inclusivity and gender neutrality in beauty are turning from niche trends to industry imperatives. Brands are already broadening their product lines with gender-neutral formulations, addressing a growing global conversation around self-expression and personal identity. Diversity in model representation, marketing language, and product benefits will be key to long-term global relevance.

Beauty x Biotech

Biotech integration is on the rise. The next wave of K-beauty is likely to leverage state-of-the-art biotechnology—think lab-grown actives, fermented extracts optimized for efficacy, and microbiome-balancing formulas designed in partnership with medical experts. This evolution will reinforce Korea’s leadership at the intersection of cosmetic science and sustainability.

Sustainability

Sustainability will be more than a buzzword. Beyond recyclable packaging and green ingredients, future-ready K-beauty brands are tackling the full lifecycle. That includes reducing water usage in manufacturing, carbon-neutral supply chains, and cradle-to-cradle design. In regulatory-driven regions especially, this holistic commitment will set leaders apart from followers.

Ingredient Sourcing

Global ingredient sourcing will diversify. As consumers become more ingredient-savvy, brands will look both within Korea and beyond for next-generation actives. It all comes down to sourcing rare botanicals, adopting ethically harvested naturals, and collaborating across borders to co-develop hybrid solutions that combine the best of multiple cultures.

What ties these trends together is the sector’s relentless focus on user-centricity and its ability to read, and often set, the pulse of global beauty. As borders blur and technology accelerates, K-beauty is uniquely positioned to meet a world of changing demands with agility, creativity, and a distinctly Korean stamp of quality.

Conclusion

K-beauty’s position in 2025 is the result of vibrant innovation, global adaptability, and a powerful connection with today’s consumers. The dominance of skincare, the meteoric rise of online retail, and the distinct strategies by region reflect a market that is agile, never static.

What emerges from this data-driven look is clear: K-beauty’s segmentation is more than a business strategy; it’s a story of cultural resonance and continuous reinvention. Brands thriving in this space are those who grasp that trends aren’t universal—the routine in Seoul, the ingredient palette in Paris, and the shopping habits in Los Angeles each deliver unique insights.

Remaining competitive isn’t about copying formulas or marketing ingredients; it’s about staying ahead. Instead, it’s about tuning into shifting consumer mindsets, leveraging technology, and building a resilient, multi-channel presence rooted in authenticity. Whether through AI-personalized routines, sustainability initiatives, or dynamic influencer relationships, the brands that succeed will be those that see segmentation as a living, breathing roadmap—one that changes as quickly as the world of beauty itself.

In this landscape, continuous data and trend mapping aren’t just helpful—they’re essential. Brands, retailers, and even consumers who follow the numbers and adjust with the times will help define the next chapter of Korean beauty, both at home and around the globe.

If you’re looking to promote your products and connect with international buyers, please don’t hesitate to contact us.